Apparel retailing - where to from here?

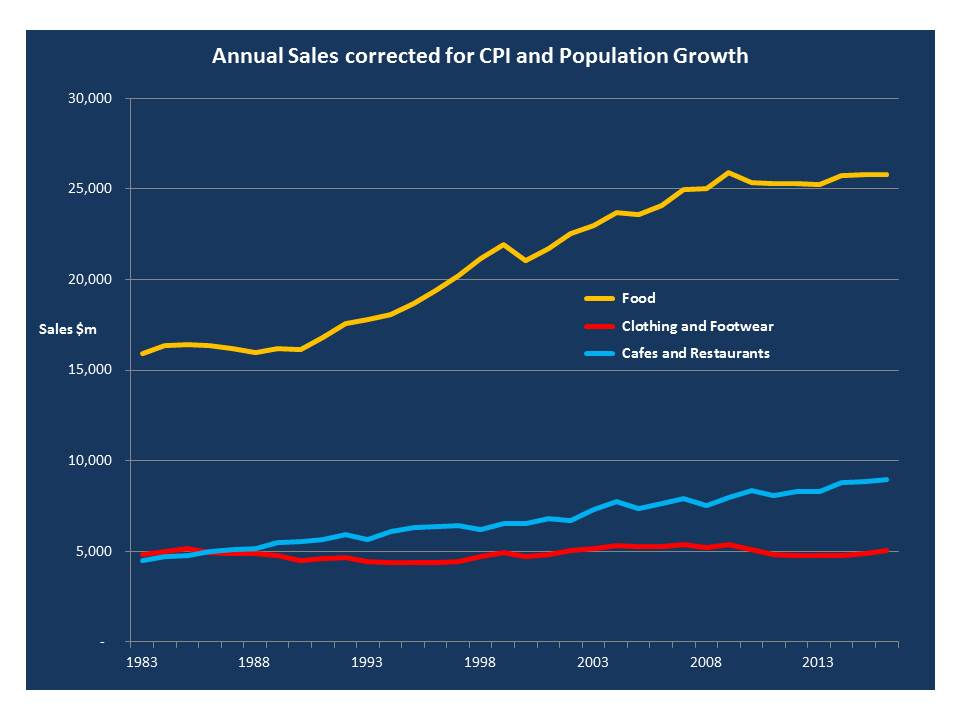

It's probably not news to anybody about the parlous state of apparel retailing in Australia at the moment. One look at the graph below shows exactly what's been going on for the last three decades. In this chart, I've taken the annual ABS sales data for the three categories; Food, Clothing & Footwear and finally Cafes & Restaurants and then corrected them for CPI and Population growth. In other words, it represents the sales in each year as if we had a static population and in 1983 dollars.

Both Food and Cafes have performed reasonably well with compound average growth rates of 1.5% and 2.1% respectively over the 33 year period. As the data is corrected for CPI and Population changes, this is real growth. It is interesting to note how the food line has been leveling off in the last seven or eight years, no doubt as a result of Aldi and the "Down, down" push at Coles and more recently Woolworths.

Although Apparel retailing has been making the headlines for all the wrong reasons in 2016/17 with several companies going into administration, the source of the problem can actually be tracked right back to the early 1980's as this category hasn't shown any real growth above CPI and population growth in all that time. To make matters worse for the local retailers, you also need to factor in the impact of the overseas retailers in the last 5 years.

As a share of wallet, we are spending substantially less on clothing and footwear than ever before and more on coffee!

So what changed in the 1980's and without any real growth, how have apparel/footwear retailers been able to survive at all?

The biggest single change was the move from local production to sourcing predominantly from China. It might sound odd, but in a way apparel retailers are a victim of their own success in driving down cost prices. Today we can buy a T-shirt or a pair of jeans for less than what we could in the 1980's, whereas with CPI over that period of time, it should be selling for 3 times that price. Not only have we imported cloths, we've imported deflation.

A growing population has protected the local apparel retailers to some extent as more stores gives larger players a broader base to amortise head-office costs, but fundamentally the only way retailers have managed to survive in that time is by driving costs lower and lower and increasing margins. Sadly I suspect we are just seeing the tip of the iceberg when it comes to further casualties, as the room to move in terms of better cost prices and higher sell prices is progressively diminishing. Then throw in the ever-increasing intensity of competition from off-shore and it's not a healthy picture.

However, while higher margins have saved the day so far, there is another sting in the tail.

More on this next week.....